Trading Alchemy in Stock Market Cycles: Revealing the Secrets of the Cup and Handle Pattern with Geocosmic Insight

August 10, 2023

Introduction

In this guide, we will unveil the secrets of the inverse cup and handle, reverse cup and handle, cup and handle pattern target, cup and handle trading strategies, and how to navigate cup and handle pattern failures. Read on to gain valuable insights into these patterns using geocosmic analysis, and learn how to optimize your trading strategies.

Understanding the Cup and Handle Pattern

The Cup and Handle pattern is a powerful technical analysis pattern that often indicates a bullish continuation in a stock’s price trend. This pattern forms after a significant upward movement followed by a period of consolidation. Its distinct shape resembles a cup with a handle, hence the name. Additionally, there are variations known as the inverse cup and handle and reverse cup and handle, which present different trading opportunities.

Estimating the Cup and Handle Pattern Target

Determining the potential price target of the cup and handle pattern is a crucial aspect of successful trading. To estimate the target, measure the distance from the bottom of the cup to the top, and add that distance to the breakout level. This projection provides a potential price target for the stock’s upward movement after the pattern formation. It’s important to note that this target serves as an estimation, not a guarantee, and other factors should be considered in trading decisions.

Decoding Market Cycles: Using Geocosmic Codes for Stellar Trading in Forex Markets

August 10, 2023

Introduction

In this article, we will be covering market structure in the forex realm, delve into the concept of market structure charts, and explore how incorporating geocosmic codes can lead to stellar trading success. So, fasten your seatbelts and get ready to decode the mysteries of market cycles!

Unveiling the Power of Market Structure in Forex

To navigate the forex markets with confidence, understanding market structure is paramount. Market structure refers to the arrangement and organization of price movements within a given timeframe. By examining market structure charts, traders can discern crucial patterns and levels that guide their trading decisions. These charts reveal swing highs and swing lows, trendlines, channels, support and resistance levels, all of which provide valuable insights into market dynamics.

Geocosmic Perspective on Market Cycles: Unleashing the Power of Astro-Trendline Mastery

August 10, 2023

Introduction

In this article, we delve into the powerful realm of astrology and its application in understanding market trends. Specifically, we will uncover the secrets of drawing trendlines with precision and accuracy. So grab your pens, charts, and an open mind as we embark on this journey of astro-trendline mastery.

Unveiling the Magic of Astro-Trendlines

Trendlines are an essential tool in technical analysis, allowing traders to identify and validate the direction of price movements. But what if we told you there’s a hidden dimension to trendline analysis that can significantly enhance your trading decisions? That’s where astro-trendlines come into play.

Astro-trendlines combine traditional trendline drawing techniques with the insights of astrology, harnessing the cyclical energies of celestial bodies to refine your market analysis. By incorporating planetary alignments, retrogrades, and other astrological phenomena, we can gain a deeper understanding of market cycles and potential turning points.

Market Cycle Trends: Mastering Higher Highs and Lower Lows Through Geocosmic Indicators

August 10, 2023

Introduction

The language of market cycle trends often uses the phrases “higher highs and lower lows.” To those unfamiliar with the world of finance, these terms might seem strange. In essence, these terms refer to the peak and trough points of a particular market cycle. In this context, we must ask: “what is a higher low?” A higher low refers to the point in a market cycle where the price dips but does not go as low as the previous low point. In other words, the low is higher than the preceding one, hence “higher low.” This concept is instrumental in understanding the intricate patterns that define market behaviors and trends.

Understanding Market Cycle Trends

The rhythmic dance of “higher high and lower low” patterns defines market cycle trends. These terms represent crucial turning points in the markets: a “higher high” is a peak point that is higher than the preceding peak, while a “lower low” refers to a trough that is lower than the previous trough. Recognizing these patterns can provide invaluable insight into the direction a market is likely to take. For example, a series of “higher highs and higher lows” suggests an upward, or bullish, trend.

The principles guiding these patterns, known as “Trend Analysis,” have been key to the success of MMA Cycles. Incorporated after the groundbreaking work of Raymond Merriman, the company recognized the importance of these patterns across various market cycles, including the Economic Cycle, The Business Cycle, The Credit Cycle, and The Property Cycle.

Forecast 2023 Scorecard- As of August 1, 2023

August 04, 2023

FORECAST 2023 SCORECARD AS OF JULY 24, 2023

Every year gets better and better with our forecasts. Although 2023 is not yet over, several forecasts made in the Forecast 2023 Book have already unfolded. We will list a few of the forecasts below as of July 24. Keep in mind these forecasts were written in October-November 2022, and published December 2022, well before 2023 got underway. As far as market sectors go, 2023 was an awesome year for forecasting, with the exception of Gold, which bottomed as we were writing the 2023 book. Particularly awesome were the Stock, currencies, and Bitcoin markets. Read below.

ECONOMIC AND MARKET FORECASTS FOR 2023 (written August 1-November 20, 2022)

The U.S. Stock Market and DJIA: “Our focus will be on a 3-year cycle low due March 2023 +/- 6 months. It may have already happened on October 13, 2022, when prices fell to 28,660. The price target for this low is 27,582 +/- 2211 At the same time, we do not expect the DJIA to rally more than a range of 2% from the all-time high of 36,952 of January 2022, and maybe not even that high. Traders may look to buy on declines to 27,500-29,000 in 2022 with stop-losses based on one’s risk tolerance and sell if the DJIA shows resistance between 35,500-37,500, especially if it happens near a geocosmic critical reversal date listed below.” As of August 7, the low of October 13, 2022 is holding and the high is now 35,679, in our upside price target range given. Six of the eight (and maybe 7 of the 9) critical reversal dates given have been within one trading days of a major reversal so far

Forecast FAQs

July 31, 2023

Our Annual Forecast Pre-Order Event will run from August 8- October 31 2023. Our Forecast Books will be mailed out around Late- December 2023. We cannot guarantee domestic or international orders will be received by the buyer before Christmas or Hanukkah. We created a list below of our most common FAQs to help this Forecast season. We are always available to answer any of your Forecast questions via email at CustomerService@mmacycles.com.

Forecast Club Levels

July 30, 2023

Every August MMA runs our annual Forecast Pre-Order Event. If this is your first Forecast season with us, welcome! If you have been ordering the Forecast Book for years, welcome back and thank you for your continued support. This is our favorite, and most busy, time of year.

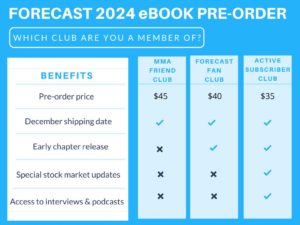

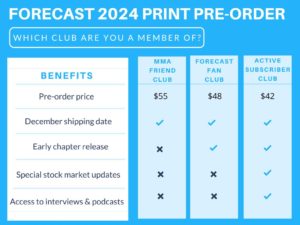

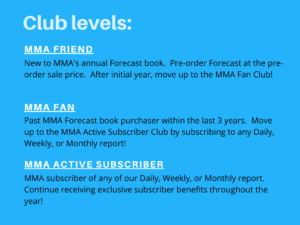

Everyone is invited to be part of our special event where you can pre-order the Forecast 2024 Book at a discounted price through the end of October AND save 10% on MMA subscription reports. If you have ordered Forecast in the past three years, then you are part of our Forecast Fan Club and will be sent a coupon code on August 8th to save an additional $7 on Forecast 2024 Print or Bundle and $5 on Forecast 2024 eBook. If you are an active subscriber, then you are part of our Active Subscriber Club and you will be sent a coupon code on August 8th to save an additional $13 on Forecast 2024 Print or Bundle and $10 on Forecast 2024 eBook. Being a member of the MMA Forecast Fan Club (past purchaser of Forecast Book) or a member of the MMA Active Subscriber Club (current subscriber to paid reports) have additional benefits listed below.

To learn more about our annual event, please check out our Annual Forecast Pre-Order Event Page and Forecast FAQ Page which hosts a wealth of information. You may also send us email to CustomerService@mmacycles.com with any questions you have.

Visit our Forecast 2024 Page on August 8th to pre-order Forecast 2024.

MMTA3 Frequently Asked Questions

January 30, 2023

Thank you for your interest in MMA’s Market Timing Academy, MMTA3 beginning in March 2023.

We have created a list below of our most common questions we have been asked by prospective students of MMTA3. We are always available to answer any of your questions via email at MMTA@mmacycles.com. You may also connect with program director, Gianni Di Poce, Gianni@mmacycles.com, if you wish to learn more about MMTA3.

We have a MMTA3 Program Schedule available to review where we explain the topics covered throughout the program. We also created a MMTA3 Common Questions document where we address time, cost, and value of MMTA3.

We will continue to update this list of Frequently Asked Questions as we approach out March start date of MMTA3.

Watch MMTA Q&A Webinar with Gianni and Ray hosted in February 2023 to learn more about the upcoming program.

If you have not already done so, please hear what some of our MMTA2 students had to say about their experience in 2021-2022. You may also hear what our MMTA1 graduates had to say about the original MMTA program offered in 2013-2014. Watch this interview between Ray and Gianni from 2020 where they discuss what information will be covered in the MMTA program.

We look forward to having you join us in March for MMTA3!

Forecast 2022 Scorecard- As of July 25, 2022

October 23, 2022

Every year gets better and better with our forecasts. Although 2022 is not yet over, several forecasts made in the 2022 book have already unfolded. We will list a few of the forecasts below as of July 25. Keep in mind these forecasts were written in October-November 2021, and published December 2021, well before 2022 got underway.

ECONOMIC AND MARKET FORECASTS FOR 2022 (made prior to December 1, 2021) The U.S. Stock Market and DJIA: “…In today’s terms, this (Jupiter/Saturn cycle phase) would imply a peak is happening now, as we enter 2022, and a bottom in 2022-2023… However, our bias is that the U.S. stock market will make a double-digit decline from its all-time high into a 22.5- or 24- month cycle low that is due by July 2022.. We expect the end of the cycle will exhibit the steepest decline (since March 2020), which so far has been 10.46% in October 2020…The ideal decline in the DJIA would be 10-20%.” – Result: The DJIA made its all-time of 36,952 on January 5, 2022. It’s low as of this writing has been on June 17, 2022 at 29,653, which is a decline of 19.75%.

Forecast 2021 Scorecard- As of July 21, 2021

August 01, 2021

Every year gets better and better with our forecasts. Although 2021 is not yet over, several forecasts made in the 2021 book have already unfolded. We will list a few of the forecasts below as of July 21. Keep in mind these forecasts were written in October-November 2020, and published December 2020, well before 2021 got underway.

ECONOMIC AND MARKET FORECASTS FOR 2021 (made prior to December 1, 2020)The U.S. Stock Market and DJIA: “… There are reasons to support a continuation of the bull market off the lows of March 2020… The next sign of potential trouble for the bull market in the U.S. stock market will happen if and when the DJIA takes out support at 25,000–26,000. Until then, our advice for investors is to stay with bullish strategies. That is, buy corrective declines (even if sharp) into the 50-week and 16.5-month cycle lows due in 2021. But as long as the DJIA does not fall below 25,000–26,000, it is probably a buying opportunity.” The DJIA never traded that low. Instead, it continued to rally and as of this writing, it has made a new all-time high 35,631 as of August 16, just four days before the August 20 critical reversal date listed in the book. The S&P and NASDAQ have continued making new all-time highs on September 3 and 7 respective, right on the September 3-6 critical reversal date listed.