The financial markets are a dynamic landscape, offering opportunities and challenges for traders and investors alike. To navigate this ever-changing terrain successfully, one must employ the right strategies, and one such strategy is position trading. In this article, we will explore the concept of position trading and its significance in today’s financial markets. We will also delve into the world of Merriman Market Analyst (MMA) and how it can assist traders in gaining valuable insights into market cycles.

What is Position Trading?

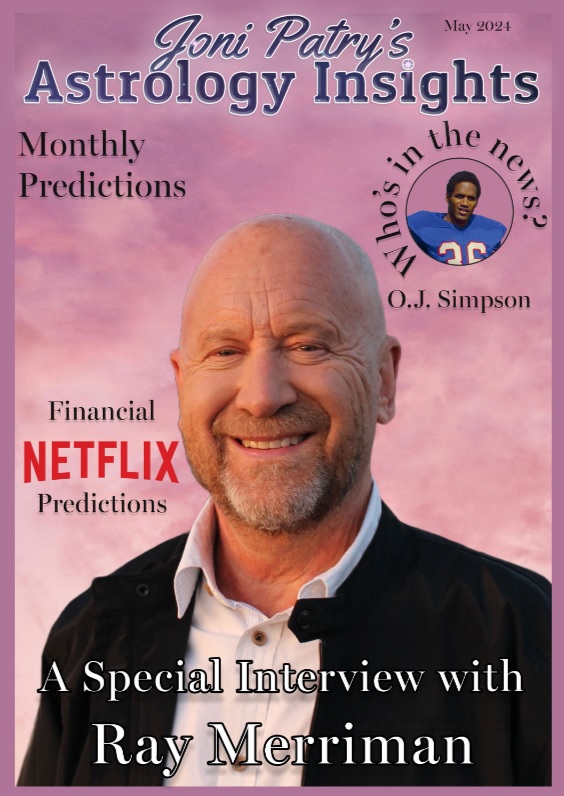

Position trading is a trading strategy that focuses on the long-term prospects of financial assets. Unlike day trading, which involves making quick, short-term trades, or swing trading, which aims for moderate gains over days or weeks, position trading extends over much longer periods. Raymond A. Merriman, the President of The Merriman Market Analyst, Inc., defines position trading as a strategy with a horizon of three months or longer. The key principle is that the longer the planetary cycle unfolding, the longer the market cycle that’s unfolding.

Position trading is built on the foundation of thorough research and analysis. Traders utilizing this strategy often base their decisions on comprehensive market research, economic indicators, and technical analysis. It’s a strategy that requires a patient, disciplined approach.

Position Trading Strategies

Successful position trading demands a well-defined strategy. Traders must carefully select their entry and exit points, set stop-loss orders, and diversify their portfolios. While there is no one-size-fits-all approach, some common position trading strategies include trend following, breakout trading, and value investing. The choice of strategy often depends on the trader’s risk tolerance and market outlook.

MMA offers advanced tools and resources that can aid traders in implementing effective position trading strategies. These tools provide valuable insights into market trends, helping traders make informed decisions and increase their chances of success.

Continue reading… Position Trading in Market Cycles: Long-Term Strategies