The leader in Market Timing Products and Services

Shop Products & ServicesAs Seen On

Merriman Market Analyst

Innovative market timing solutions, leveraging a combination of advanced analytical methodologies.

See How it WorksEmpowering Investors with Market Insights - Merriman Market Analyst combines decades of expertise with innovative tools to give investors a unique edge in navigating financial markets. Through market timing, geocosmic cycles, and technical analysis, we provide resources and education to help traders make informed decisions and take control of their financial future.

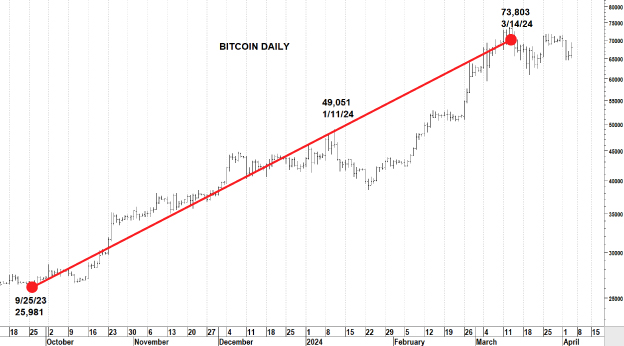

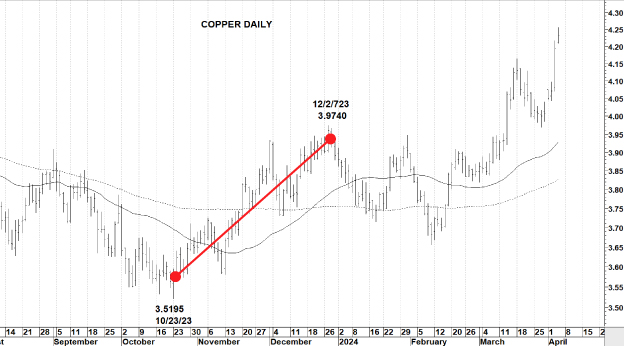

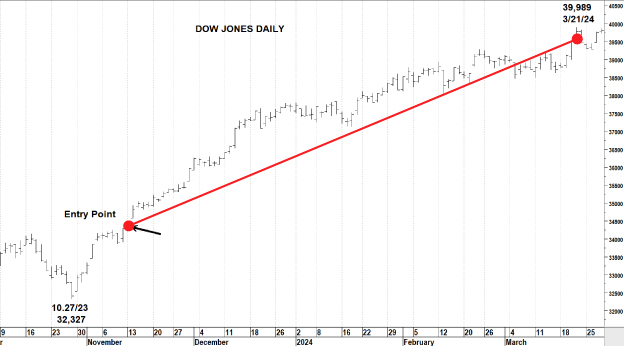

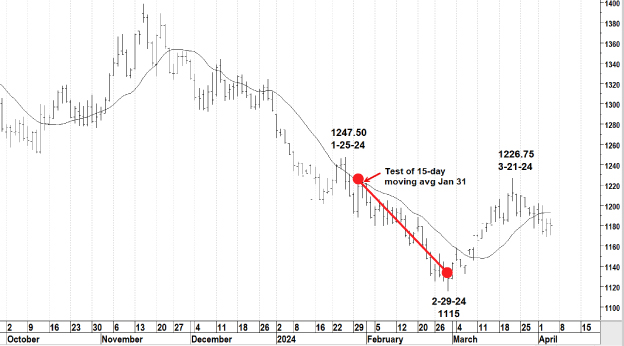

Scorecard 2024

A Track Record of Performance

Economic and Market Forecasts for 2024

Our Products

Tailored Market Insights

Utilizing sophisticated research methodologies, we offer avant-garde tools that grant unparalleled foresight. Our arsenal seamlessly integrates Cycles, Geocosmic Signatures, and Trend Analysis patterns, empowering discerning investors with invaluable market interpretation capabilities.

Join us in navigating the intricacies of the financial landscape, where precision and efficacy converge. Subscribe to Merriman Market Analyst and embark on a path to informed and strategic investment decisions.

Shop Products

Our Experts

Our comprehensive approach to market prediction provides unparalleled insights and market-beating results.

Drawing from diverse backgrounds in commodities and currencies, our global team of analysts offers a comprehensive understanding of global markets. This breadth of experience enables them to identify unique opportunities and navigate fluctuations with precision, delivering strategic insights that drive success for our clients worldwide.

Meet the Team

Testimonials

In their words

Frequently Asked Questions

What are geocosmic patterns and cycles, and how do they work?

FAQ Content Text.

Do geocosmic signatures and cycles have any influence on the stock market?

Absolutely. The Earth’s environment is constantly bombarded by subtle energies from celestial bodies like planets, the sun, and even the moon. These energies, along with astronomical cycles, can influence human behavior and mass psychology, which ultimately impacts markets.

How can geocosmic signatures and cycles be used to predict stock market trends?

FAQ Content Text.

Can geocosmic signatures identify potential market shifts?

FAQ Content Text.

Are geocosmic signatures sole predictors of market trends?

FAQ Content Text.