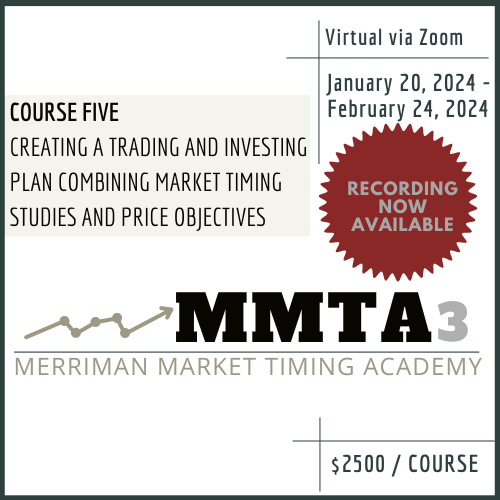

MMTA3 Course Five: Creating a Trading and Investing Plan Combining Market Timing Studies and Price Objectives (Recordings)

$2,500.00

This is Course Five of the two-year program, MMTA3, focusing on MMA Market Timing methodology of analyzing and trading financial markets as developed by Raymond A. Merriman, C.T.A. (registered Commodities Trading Advisor with the National Futures Association since 1982). Within Course Five, there will be 6 live classes times, lasting 2-3 hours each on Saturday afternoons.

The course will be taught by Gianni Di Poce, MMTA Program Director and apprentice of Raymond Merriman, with assistance from Raymond Merriman.

Full Description

All six live classes will take place between January – February 2024. Purchase of MMTA3 Course Five includes live access to six Classes as well as all six Class video recordings, Course Five workbook, 12 Lesson Presentations, and chat transcripts from live Classes.

Course Five:

This is the fifth of eight courses which make up MMTA3, a two-year program in the MMA Market Timing methodology of analyzing and trading financial markets as developed by Raymond A. Merriman, C.T.A. (registered Commodities Trading Advisor with the National Futures Association). Each course will be taught in 6-7 class sessions live via Zoom. The classes last 2.5 hours each and contain 1-3 lessons each live class. Each class will take place on Saturday afternoons, starting at 12:00 PM, EST. The classes are offered live via Zoom and each class was be recorded and is available to access through the Website portal.

Instructors:

The course will be taught by both Raymond Merriman, president of MMA and Gianni Di Poce, MMTA Program Director.

Raymond Merriman is the founder of Merriman Market Analyst, Inc (MMA) and the Merriman market Timing Academy (MMTA). He is a registered Commodities Trading Adviser (CTA) with the National Futures Association. Raymond is a financial market analyst and has been the editor of the MMA Cycles Report, a monthly market advisory newsletter, since 1982. He also writes daily and weekly reports for more active traders and has authored several books on Financial Market Timing, including the five volume series on The Ultimate Book on Stock Market Timing, Volumes 1-5, covering over 1600 pages of quantitative research studies.

Gianni Di Poce is an MMA analyst covering a span of different markets. Gianni reports on T-Notes for the MMA Monthly Cycles Report, as well as the Australian markets (index and currency), Cannabis, and Live Cattle for the International Cycles Reports. Gianni is also the editor for the MMA Crude Oil Report, which provides daily, weekly, and monthly updates for subscribers. Gianni joined MMA in 2019, but has been using MMA’s methods since 2016. He holds a Bachelor’s Degree in Economics, and served as a financial adviser for 5 years.

Cost:

Individual courses are $2500.

Books Recommended:

The New American Ephemeris: 2020-2030 and The Ultimate Book on Stock Market Timing, Volume 5: Technical Analysis and Price Objectives

Live Class Dates:

• January 20, 2024

• January 27, 2024

• February 3, 2024

• February 10, 2024

• February 17, 2024

• February 24, 2024

Lessons Covered:

Lesson 1: Qualitative versus Quantitative understanding of Planets, Signs, and Aspects

Lesson 2: Preparing for a Daily Trading Plan

Lesson 3: Importance of Level 1 Signatures in Identifying Potential Geocosmic Critical Reversal Dates (Quantitative)

Lesson 4: Importance of Solar/Lunar Combinations for Short-Term Trading Plans

Lesson 5: Price Objectives for Long-term Cycles

Lesson 6: Price Objectives- 4-Year Cycles in Stocks

Lesson 7: Moving Averages’ Application as Trend Analysis Indicators in Long-Term Cycles

Lesson 8: Fibonacci Correction Rules in Price Objective Calculations for Trend Runs Up and Down

Lesson 9: The 45-85% Correction Rule for Half-Cycle Retracements

Lesson 10: The Mid-Cycle Pause Price Objective (MCP)

Lesson 11: The .618 Calculation for Price Targets in the Third Phase of a 3-Phase Cycle

Lesson 12: The 1.618 Calculation for Price Targets in the Third Phase of a 3-Phase Cycle and Other Chart Patterns

Who will benefit from this training:

The MMTA program is a two-year program comprised of eight courses covering 112 Lessons. The purpose is to teach one the methodology of analyzing financial markets, and to train students in market timing skills, according to the studies developed by Raymond Merriman since 1980. Graduates of the MMTA program will receive certificates of completion, which will be recognized by others in the field as a solid grounding as a market analyst specializing in the art of market timing. Several graduates of the previous MMTA programs are now paid analysts for various reports published monthly by MMA. Others have gone on to start their own market letters or work as analysts for other financial firms. Several have simply used the learning to manage their own – or their family’s – trading and investment accounts.

The MMTA program is most beneficial for those who wish to become excellent analysts and/or market timers. A certificate of completion will be granted to those students who complete all Research Projects and pass all Exams. wish to be recognized as MMTA graduates.

However, one may take individual courses for his/her own benefit. It is not necessary to take exams or do research projects if one does not wish a certificate of completion.

Each class session will recorded. All students will have access to review the video recording of the classes at any time.

Please see a more detailed MMTA3 Program Schedule HERE