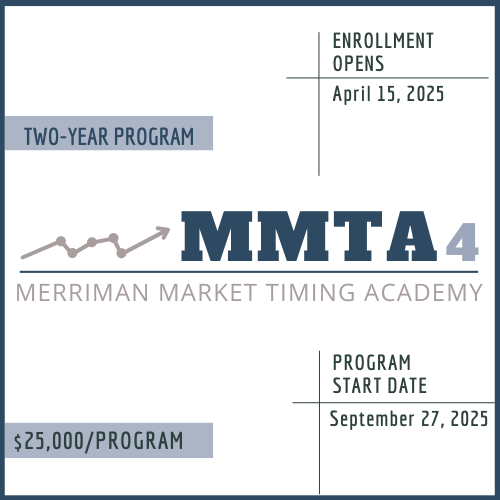

MMTA4: Two-Year Program

Original price was: $25,000.00.$21,500.00Current price is: $21,500.00.

Two-Year MMTA4 Program.

Early Registration Discounts Available:

$21,500: If enrolled by July 1, 2025

$22,500: If enrolled by August 1, 2025

Please note, we also offer installment payments options that include an additional fee. Please send us an email if interested in an installment payment option.

ENROLLMENT IS NOW OPEN FOR THE TWO-YEAR MMTA4 PROGRAM.

The entire MMTA4 program is two years long and will cover eight courses. Each course is approximately 6-8 weeks long, with a break in between each course, and a 3-month break between years one and two. In each class session, we will cover 1-4 lessons. Each course is finished with an exam and research assignment for students who wish to graduate and receive a certification.

Read our MMTA4 FAQ and visit our Common Questions Document on TIME, COST, and VALUE

Review our MMTA4 Program Schedule to see what topics will be covered over the two-year program

Full Description

MMTA4

Program Start Date: September 27, 2025

Program:

The Merriman Market Timing Academy (MMTA) is a comprehensive educational program designed for aspiring financial analysts, market timing specialists, investors, and traders. Over eight structured courses, students explore leading indicators such as financial market cycles, geocosmic correlations to long-, intermediate- and short-term market cycles as well as advanced technical analysis methods, including price objectives calculations, chart patterns and support and resistance calculations. The program equips students with the skills to accurately forecast market reversals, write market reports for different time frames as well as derive and execute investment and trading strategies. Extensive practical exercises and real-world applications ensure students gain valuable hands-on experience. Upon completion, graduates are fully prepared to enter roles as skilled market analysts or traders, armed with advanced strategies and a disciplined approach to consistently navigate financial markets successfully. Explore further to discover how MMTA can transform your market analysis and trading capabilities.

The entire MMTA4 program is two years long and will cover eight courses. Each course is approximately 6-8 weeks long, with a break in between each course, and a 3-month break between years one and two. In each class session, we will cover 1-4 lessons. The classes will be offered live online via Zoom and each class will be recorded and made available to access through the Website portal by the following Monday. Each course is finished with an exam and research assignment for students who wish to graduate and receive a certification.

Instructors:

The program will be led by both Raymond Merriman, president of MMA and Wiebke Held, MMTA Program Director. In additional to Merriman and Held, we have MMA faculty who will be joining to teach many of the classes as well. The MMA faculty that will join MMTA4 are: Gianni Di Poce, Wyatt Fellows, Pouyan Zolfagharnia, Derek Panaia, Rita Perea, and Kat Powell.

Cost:

The cost for the two-year program (all 8 courses) is $25,000

Who will benefit from this training:

The MMTA program is a two-year course. The purpose is to teach one the methodology of analyzing financial markets, and to train students in market timing skills, according to the studies developed by Raymond Merriman since 1980. Graduates of this course will receive certificates of completion, which will be recognized by others in the field as a solid grounding as a market analyst specializing in the art of market timing. Several graduates of the first MMTA program are now paid analysts for various MMA and ICR reports published monthly by MMA. Others have gone on to start their own market letters or work as analysts for other financial firms. Several have simply used the learning to manage their own – or the family’s – trading and investment accounts.

The MMTA program is most beneficial for those who wish to become excellent analysts and/or market timers. A certificate of completion will be granted to all of those who wish to be recognized as MMTA graduates. Taking exams at the end of each course, plus a final exam at the completion of all courses, is required. Also required will be research studies conducted and presented, which may do solely or with one or two other fellow students wishing to become MMTA graduate. However, one may take the program for their own benefit if one does not wish a certificate of completion. Each class will be recorded and students will have access to review the video recording of the classes at any time.

For additional information please email us at: mmta@mmacycles.com

Schedule

Year One: 2025-2026

Course One: Cycles and Chart Patterns in Financial Markets

Dates: September 27, 2025, October 4, 2025, October 11, 2025, October 18, 2025, October 25, 2025, November 1, 2025, November 8, 2025, November 15, 2025

Course Two: Geocosmic Correlations to Long-Term Cycles in Financial Markets

Dates: January 10, 2026, January 17, 2026, January 24, 2026, January 31, 2026, February 7, 2026, February 14, 2026

Course Three: Geocosmic Correlations to Trading Cycles in Financial Markets

Dates: March 14, 2026, March 21, 2026, March 28, 2026, April 11, 2026, April 18, 2026, April 25, 2026

Course Four: Solar-Lunar Correlations to Short-Term Reversals in Financial Markets

Dates: May 16, 2026, May 21-25, 2026 (live in person), May 30, 2026, June 6, 2026

Year Two: 2026- 2027

Course Five: Creating a Trading and Investing Plan using Market Timing Studies and Price Objectives

Dates: September 26, 2026, October 3, 2026, October 10, 2026, October 17, 2026, October 24, 2026, October 31, 2026

Course Six: Advanced Technical Analysis Methods for Short-Term Trading

Dates: December 5, 2026, December 12, 2026, January 9, 2027, January 16, 2027, January 23, 2027, January 30, 2027

Course Seven: Advanced Support and Resistance Calculations for Short-Term Trading

Dates: February 27, 2027, March 6, 2027, March 13, 2027, March 20, 2027, April 3, 2027, April 10, 2027

Course Eight: Putting It All Together: Market Reports, Trading Plans, and Execution

Dates: May 8, 2027, May 27-31, 2027 (live in person)